Oil and Gas News: Declining fossil fuels still dominate; China importing more US oil

Fossil fuels fall again but still dominate US energy mix

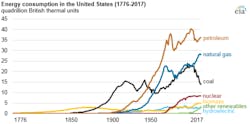

While fossil fuels made up the lowest share of total U.S. energy consumption since 1902, petroleum, natural gas and coal still account for more than 80 percent of U.S. energy consumption, said the U.S. Energy Information Administration (EIA).

The fuel sources declined for the third year in row in 2017, driven by slight coal and natural gas consumption decreases. Since peaking in the U.S. in 2005, coal consumption in the country has declined nearly 40 percent.

While natural gas consumption has increase in eight of the past 10 years, it fell by 1.4 percent in 2017. Natural gas consumption in the U.S. increased by 24 percent from 2005 to 2017.

Petroleum consumption increased in 2017 but remains 10 percent lower than it did at its peak 2005 level.

Meanwhile, renewables were up 11.3 percent, the highest share of total energy consumption they have seen since the late 1910s. Solar and wind electricity generation account for the largest growth over the past decade.

Graphic courtesy of the EIA

China grows as US energy importer

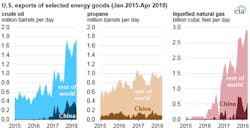

China has been of the largest importers of U.S. crude oil, propane and liquefied natural gas (LNG) exports over the last few years in response to its growing domestic energy consumption.

In 2017, China received more U.S. crude oil than any other destination except Canada. It became the world’s largest gross crude oil importer in 2017 when it passed the U.S. EIA data indicate China’s crude oil imports continue to increase, averaging 330,000 barrels per day (bb/d). The U.S. sent more crude oil — mostly from the Gulf Coast region — to China in February than to any other location.

Nearly half of U.S. propane exports went to China in 2017, with China as the third-largest destination for these exports. The country received 92,000 b/d through April, which is 31 percent lower than U.S. propane exports during the same time period in 2017.

China is also the third-largest importer of U.S. LNG, with 15 percent of production going to the country. China is the second-largest importer of LNG in the world, surpassing South Korea in 2017.

Graphic courtesy of the EIA

Brent crude oil prices to fall slightly in 2019

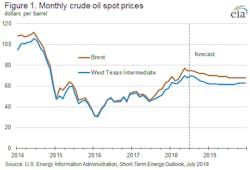

The EIA expects Brent crude oil prices will average $73 per barrel (b) in the second half of 2018 before dropping to $69/b in 2019, according to the agency’s latest Short-Term Energy Outlook update. West Texas Intermediate crude oil prices are forecast to average $7/b lower than Brent prices in the second half of 2017, then $7/b lower in 2019.

A looser oil market is expected from the second half of 2017 until the end of 2019 as well. Global petroleum and other liquid fuels inventories should remain relatively unchanged in 2018 before increasing by 0.6 million b/d in 2019. The increase is largely driven by expected liquid fuels production growth in the U.S., Brazil, Canada and Russia.

In the U.S. alone, the EIA said crude oil production will average 10.8 million b/d in 2018, up 1.4 million b/d from 2017, then it will grow to 11.8 million b/d in 2019. These numbers would surpass the country’s previous record of 9.6 million b/d from 1970. Of the expected 12 million b/d of crude oil production growth from June 2018 to December 2019, the EIA forecasts that 0.6 million b/d will come from increased production from tight rock formations in the Permian region of Texas and New Mexico.

Graphic courtesy of the EIA

Natural gas consumption up in 2018

PointLogic Energy data show that natural gas supply and consumption have grown from the first half of 2017 to the first half of 2018. Consumption rose 11 percent to 87.4 billion cubic feet per day (Bcf/d) in the Lower 48 states in 2018. Natural gas supply rose 10 percent to 84.8 Bcf/d. The most growth occurred in commercial and residential consumption. Export growth was also a contributor; liquefied natural gas and net pipeline exports to Mexico grew 23 percent.

EIA: Gasoline prices to decrease

The EIA said that U.S. gasoline prices hit their peak for the summer on May 28 when they reached $2.96 per gallon. The agency said prices will fall to $2.84 per gallon in September, then down to $2.68 per gallon by December. Gasoline is often more expensive in the summer months because of increased demand and regulatory requirements to manufacture summer-grade gasoline, which costs more to produce.