World Industrial & Municipal Flow Control Revenues to Exceed $90 Bil. In 2012

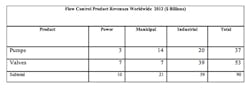

Pump and valve purchases in 2012 by power plants, municipalities and industry will be $90 billion, according to forecasts from the McIlvaine Company’s publications Pumps World Markets and Industrial Valves: World Markets.

The reports show the biggest purchasers in the power industry will be investors in coal-fired power plants. Most of these power plants are being built in Asia. Combined-cycle gas turbine construction will account for a relatively small portion of the power total. The nuclear industry represents an even smaller segment. A sizable portion of the investment in a new hydropower plant is for flow control, but only a few large hydro plants will be built in 2012.

Municipal wastewater treatment plants use more pumps and valves in the treatment process than do drinking water plants. The amount of water moved from and to the plants is roughly equal. Water reuse is becoming much more popular recently. This expands the market for treatment and, in some cases, also increases the transport requirements, McIlvaine says. A counter trend is sewer mining, whereby a golf course or some other water user would tap into the nearby sewer line and extract the raw sewage. Purified water would be utilized and the sewage returned to the line.

Industry uses more pumps and valves than the power and water utilities combined. Refineries, pulp mills, mines and many other industries use large quantities of water and must treat and/or reuse substantial percentages. The largest single recirculation requirement is for cooling. Wet grinding and movement of products in slurries are two other big uses.

Asia is the largest purchaser and will continue to gain over the other regions in the next five years, McIlvaine says.