Danfoss to Acquire Vacon—2 of the Top 10 Low-Voltage VFD Suppliers Join Forces

Denmark’s Danfoss A/S has bid $1.34 billion for the acquisition of Finland’s Facon Oyj, which would result in the union of two of the 10 largest variable frequency drive suppliers globally. According to IHS, the combined low-voltage drive revenue from the two companies represent over 10 percent of the global market value; this is slightly less than the estimated market shares for ABB and Siemens, the two largest suppliers of low-voltage drives globally.

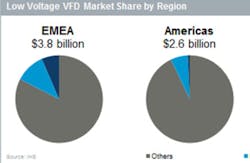

As the figure above indicates, both companies have strong market share in EMEA and Asia Pacific regions. The combination of the Vacon and Danfoss VFD businesses will compete heavily in these regions, where traditionally only ABB and Siemens have competed for top market share. Further, the Danfoss announcement lauds Vacon’s strengths in China, Finland, India, Italy, and the United States.

READ ALSO: Low–Voltage VFD Market Poised for Growth in 2014

According to a Danfoss press release, the combination of the Vacon and Danfoss drive businesses is expected to create “a new AC drives business with the clear ambition to build a leading position in the AC drives market.” While VFD market analyst Kevin Schiller from IHS agrees that the acquisition will secure a stronger foothold for the Danfoss and Vacon drive products, the newly formed drives business resulting from the acquisition of Vacon by Danfoss will not resemble its competitors. “ABB and Siemens cultivate much of their drives business alongside their sizeable share of the integral AC motor market, and are able to offer complete system solutions across all power ranges. Conversely, Danfoss has a comparatively undersized standalone motor market share,” Schiller said. “However, with significant market share in drives integrated with motors and end equipment, the new Danfoss and Vacon integration will most likely affect the competitive landscape in lower power ranges—below 50 kW.”

Through the acquisition of Vacon, Danfoss hopes to become the leading supplier of drives within the Nordic region, which has an estimated market size of over $500 million. This region is expected to grow slightly slower than the market average, at just over 7 percent CAGR, from 2013 to 2018. While Danfoss has traditionally concentrated on the HVAC industry, the addition of Vacon’s business will diversify sales channels and strengthen product portfolios in the power generation and building automation sectors.

The acquisition is contingent upon approval by relevant authorities (e.g. competition authorities), and Danfoss gaining control of over 90 percent of Vacon shares.