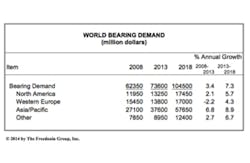

Global demand for ball, roller, and plain bearings is projected to rise 7.3 percent annually to $104.5 billion in 2018, according to a new study from The Freedonia Group Inc., a Cleveland-based market research firm.

Product sales will be fueled by healthy gross fixed investment and durable goods output growth as world economic conditions improve. Also contributing to value gains will be a shift in the product mix toward more expensive, better performing units, supported by increasingly complex designs in bearing-using products and by high energy prices, which make highly efficient bearings a more attractive investment. These and other trends are presented in the study titled World Bearings.

“China will post the strongest gains of any national market in dollar terms,” states analyst Ken Long, “In fact, almost half of all additional product demand through 2018 will be accounted for by China.” Market advances in the country will be supported by GDP growth well above the global average, ongoing increases in fixed investment spending, strong gains in manufacturing output, and healthy levels of motor vehicle output and sales. However, India, a considerably smaller but still large bearing market, is expected to register larger annual increases in percentage terms. A number of smaller markets—including Iran, Indonesia, Turkey, Thailand, and Malaysia—will also record healthy sales advances.

READ ALSO: Case Study – Shaft Grounding Proves Essential for Bearing Protection

U.S. bearing demand is projected to climb at a 5.9 percent annual pace through 2018, representing one of the strongest market performances of any developed nation, driven by an acceleration in economic growth and durables goods output, according to the study. Product sales in Western Europe and Japan will rebound from recent declines, but market gains in these areas will be well below the world average. Advances will be limited by generally sluggish increases in durable goods output and, in the case of Japan, further decreases in motor vehicle production. Market increases in Eastern Europe will be stronger than those posted during the 2008-2013 period but not as robust as those in other developing areas because fixed investment spending, automotive output, and other durable goods production will not rise as rapidly as in the Asia/Pacific region, Africa/Mideast region, and Central and South America. This will be due in part to subpar economic growth in neighboring Western Europe, which represents a major export market for many East European manufacturers.