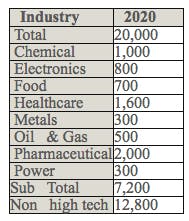

Liquid cartridge filtration sales for high-tech applications will exceed $7 billion in 2020 according to Cartridge Filters World Market published by the McIlvaine Company.

Liquid Cartridge Filtration Sales ($ Millions)

Many industries need membrane or high-efficiency nonwoven cartridges to remove very small particles from liquids. There are special conditions such as high temperature, which requires ceramics or metals. These high technology filters comprise nearly one-third of the market. Lower efficiency nonwovens and carbon block filters for residential, commercial, and industrial filtration account for the other two-thirds.

READ ALSO: MIT Researchers Look at Graphene for Durable Membrane Filtration

The pharmaceutical industry will spend $2 billion for high-technology filters in 2020. Most of these filters will be used in the manufacture of the product as opposed to water or wastewater treatment. The power industry’s use of liquid cartridge filtration for boiler feedwater is relatively modest because of the reliance on cross-flow membranes as an alternative. The food industry is also showing a preference for the cross-flow membrane technology as an alternative to cartridges. The reasons are two old:

- Cross-flow membrane systems are self-cleaning and do not need to be frequently replaced.

- Pressure loss across the systems is constant as is performance.

The pharmaceutical industry will spend $2 billion for high-technology filters in 2020. Most of these filters will be used in the manufacture of the product as opposed to water or wastewater treatment. The power industry’s use of cartridge for boiler feedwater is relatively modest because of the reliance on cross-flow membranes as an alternative. The food industry is also showing a preference for the cross-flow membrane technology as an alternative to cartridges. The reasons are two old: • Cross-flow membrane systems are self-cleaning and do not need to be frequently replaced. • Pressure loss across the systems is constant as is performance.

For more information on N024 Cartridge Filters: World Market, click on: http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/117-n024

Many industries need membrane or high-efficiency nonwoven cartridges to remove very small particles from liquids. There are special conditions such as high temperature, which requires ceramics or metals. These high technology filters comprise nearly one-third of the market. Lower efficiency nonwovens and carbon block filters for residential, commercial, and industrial filtration account for the other two-thirds.

The pharmaceutical industry will spend $2 billion for high-technology filters in 2020. Most of these filters will be used in the manufacture of the product as opposed to water or wastewater treatment. The power industry’s use of cartridge for boiler feedwater is relatively modest because of the reliance on cross-flow membranes as an alternative. The food industry is also showing a preference for the cross-flow membrane technology as an alternative to cartridges. The reasons are two old: • Cross-flow membrane systems are self-cleaning and do not need to be frequently replaced. • Pressure loss across the systems is constant as is performance.

For more information on N024 Cartridge Filters: World Market, click on: http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/117-n024