Level sensor market size worth $5.48B by 2025

The global level sensor market is anticipated to reach $5.48 billion by 2025, according to a new report by Grand View Research Inc. The food and beverage industry has challenging regulations in compliance with the Food and Drug Administration for measuring instruments and sensors, which demands advancing technology and level sensors in the food processing industry. Micro-Electro-Mechanical Systems, a part of noncontact type sensors, is expected to witness considerable growth over the projected period. Noncontact technology is anticipated to witness significant growth with a compound annual growth rate of more than 7.1 percent over the projected period. Dry bulk level sensors are used as a full indicator in silos for the storage of grain, as a jam detector in the discharge hopper of a spiral conveyor for grain, and as level controller in the flour silos of large bakeries.

The North American market is anticipated to dominate the level sensor in terms of revenue in 2016. The prevailing large existing consumer base and government initiatives to control carbon emissions are the key factors driving the North American regional growth. Asia Pacific is expected to portray the highest growth over the forecast period as it is the major hub for refineries and chemical and petrochemical processing units.

MCAA predicts US economic growth

The Measurement, Control & Automation Association (MCAA) released a report about U.S. economic growth through 2017 and 2018. The report suggested the 2.6 percent gross domestic product bounce back in the second quarter of 2017 was attributable to solid consumer and government spending. Capital spending during the second quarter increased at an adjusted annualized rate of 5.2 percent. MCAA examined spending for industrial markets and compiled their findings into the Measuring Markets newsletters. Business spending in the equipment category expanded at an 8.2 percent annualized rate during the second quarter of 2017, nearly twice as much as the 4.4 percent rate in the first quarter of the year. MCAA uses market data and business insights to provide resources and a community for manufacturers and distributors of instrumentation and systems.

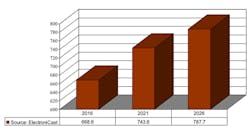

LED Luminaires used in explosion-proof lighting global consumption value forecast ($ million). Image courtesy of ElectroniCast Consultants

LED explosion-proof lighting 10-year market forecast

ElectroniCast Consultants, a market research consultancy, released a market forecast study of the worldwide use of light emitting diode-lighting (LED) luminaries (fixtures with lamp/light source) in explosion-proof lighting. Explosion-proof lights are defined as lighting products, certified in compliance to international regulative and safety standard bodies for use in areas where flammable petrochemical vapors and/or pulverized dust exist or have the potential to exist. Explosion-proof LED lighting fixtures are expected to reach $787.8 million in 2026.

According to the ElectroniCast report, in 2016 the global consumption value of LED-based luminaires used in explosion-proof lighting reached $668.6 million. The consumption (use) value is forecast to increase at an average annual rate of 2.15 percent during the first half of the forecast period (2016 – 2021) to reach $743.6 million in 2021, and then at a slower annual pace (1.16 percent) during the second half (2021 – 2026), to reach $787.7 million in 2026. The consumption value is forecast to increase with much faster rising quantity growth, slightly offset by declining average selling prices.

ITR Economics reports growth for five industrial categories in 2018

ITR Economics prepared a report exclusively for Measurement, Control & Automation Association (MCAA) members where five manufacturing categories were reviewed in-depth. The categories were chemical and chemical products, food, paper and paper products, mining and electric power. ITR predicts growth for chemical production during 2018, as well as for paper production for a short period. While the report expects categories of food and mining production to grow in slower rates in 2018, a faster growth rate is foreseen for the recovering manufacturing sector based off a 0.7 percent increase year-over-year and that growth contributing to U.S. industrial production which was up by 0.5 percent. However, U.S. Electric and Gas Utilities Production is slowing, up 0.7 percent year-over-year and is expected to contract mildly during the next two quarters. U.S. electric power generation, transmission and distribution is expected to transition to a rise by early 2018.