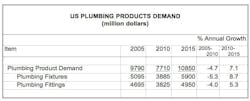

U.S. Demand for Plumbing Fixtures & Fittings to Approach $11 Bil. in 2015

U.S. demand for plumbing fixtures and fittings is forecast to rise 7.1 percent per year to $10.9 billion in 2015, spurred by a recovery in building construction expenditures from their low 2010 base, according to Freedonia Group. Also boosting demand will be a rebound in the size and number of bathrooms per new housing unit to levels common in the middle of the last decade. During the 2007-2010 downturn in housing construction, many builders installed fewer and smaller bathrooms and used less costly fixtures and fittings in the new houses that were completed, further restraining plumbing product demand. These and other trends are presented in Freedonia Group’s new study Plumbing Fixtures & Fittings.

The new residential market will see the fastest growth in plumbing fixtures and fittings demand, driven by the rise in housing completions, the study shows. However, residential improvement and repair applications will remain the largest market for plumbing products through 2015. Rebounding improvement and repair spending will boost advances. In the nonresidential market, plumbing product demand will be driven by rebounding construction activity. Such structures as office buildings, retail sites, schools, lodgings, and healthcare facilities feature intensive use of fixtures and fittings, so rising office and commercial, as well as institutional construction spending is expected to boost advances.

Plumbing fixtures demand is forecast to rise 8.7 percent annually to $5.9 billion in 2015, according to Freedonia Group. Advances will be spurred by rising unit demand.

The Freedonia Group says demand for plumbing fittings is projected to increase 5.3 percent per year to $5 billion in 2015. Growth in value demand for plumbing fittings will be checked as an increasing share of supply comes from low-priced imports. Moreover, metal prices, which grew rapidly between 2005 and 2010, are expected to rise at a more modest pace through 2015, suppressing advances. On the other hand, rebounding building construction expenditures will boost gains, as will increasing consumer interest in low-flow fittings that reduce water use and lower utility bills. These fittings are more costly than standard products, but can offer long-term savings.