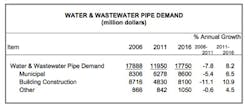

U.S. demand for water & wastewater pipe is expected to rise 8.2 percent per year to $17.8 billion in 2016, according to Water & Wastewater Pipe, a new study from The Freedonia Group. Gains will rebound strongly from declines experienced during the 2006-2011 period, in which pipe markets were negatively impacted by the 2007-2009 recession.

Going forward, the study indicates rising demand will be fueled by a more favorable environment for public infrastructure spending, noting that state and municipal governments faced severe budgetary constraints in 2011, which caused many major projects to be delayed.

Plastic will be the fastest-growing pipe material through 2016, continuing to steadily take market share from competing materials in a range of markets, according to Freedonia. Polyvinyl chloride (PVC) will remain the leading resin used in plastic pipe through 2016, due to its dominant position in small-diameter applications such as potable water distribution, sanitary sewer, and agricultural markets.

Freedonia says water & wastewater pipe demand has been battered in recent years by two trends: strained government budgets and the housing crisis. Government entities have reduced spending on sewer and water infrastructure due to financial concerns. Macroeconomic conditions have adversely impacted tax revenues and increased demand for other government services, pushing infrastructure spending down the list of priorities. Freedonia says the housing crisis has worsened the matter because local water agencies are not collecting water fees from the more than one million foreclosed homes around the country. In addition, construction spending plummeted, decimating demand for pipe in water distribution applications.

Although gains will be modest in the near term, recovery is expected in the housing market by 2016, Freedonia says. Demand for pipe in the municipal market will rebound due to improved government spending on infrastructure projects. As the economy recovers, water utility suppliers will have additional revenue to invest in pipe replacement. However, despite this improvement, Freedonia says the nation’s water infrastructure is expected to remain in disrepair and legislators and pipe industry participants hope to increase private investment in public water infrastructure via legislation that would lift limits on tax-exempt funding for water projects.