McIlvaine says the biggest growth will occur in Asia (including the Middle East and two of the BRIC countries (China and India). The oil and gas sector is leading the way toward smart valves. For sub-sea oil and gas, the use of intelligent control systems for valve trees is becoming a defining factor of intelligent well development. All electric subsea production control systems are replacing industry standard electro-hydraulic control systems, with the aim of making them more reliable, more responsive and more cost effective.

The oil and gas industry is moving toward valve technology with embedded processor and networking capability to work alongside sophisticated monitoring technology coordinated through a central control station. The goal has been to link control valves to an extended data network, coordinating control valve operation with the increasingly detailed data available on flowrates and operating conditions. Connecting valves to a network allows distributed control, which can enable operators to reconfigure piping and networking systems so that a field can continue producing even if there is a blockage in, or damage to, the pipeline network.

Another goal is to develop valves that consume less power to create systems that can be deployed in applications where conventional valves cannot be used due to the lack of power.

McIlvaine Company notes one manufacturer leading the way in smart valve development is Emerson Process Management. The range of high-performance Fisher digital valves enabled the implementation of customized valve designs to cope with the pressure, flow capacity, and temperature demands of the world's first twin-mega-train LNG plant.

The Yokogawa Exaquantum/SSP provides continuously updated subsea valve information from FMC Technologies SSH (Subsea Historian). This timely information enables users to take appropriate action if problems are detected, avoiding lost production.

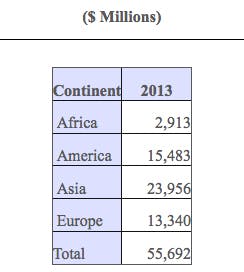

This is the latest forecast in Industrial Valves: World Markets published by the McIlvaine Company. Valve forecasts are defined to match the individual valve supplier revenues, so they include smart valve technology where it is sold by the valve supplier, but not by an independent automation supplier. For more information click here.