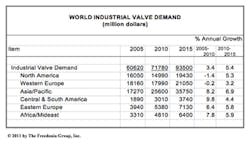

The study shows gains will be driven by continuing robust growth in the Asia/Pacific region, as well as strong recovery in the United States and West European markets from a weak 2010 base. Freedonia reports valve demand growth in the U.S. will outpace the global average through 2015 due to recovery in the domestic economy after the 2007–2009 recession. Valve demand in Japan and Western Europe will also recover from recent declines, but advances will continue to considerably lag the world average through 2015.

The study predicts the oil and gas industry will see strong growth in valve demand, with increasing offshore-, shale- and tar-sand-related exploration activities helping boost sales of higher-end products. Among the countries that will record robust increases in the unconventional oil and gas sector are Brazil, Canada, Nigeria and the U.S. Freedonia says the nuclear power market for valves will see weak gains in the developed world in the aftermath of the 2011 Fukushima disaster in Japan. Weakness in the nuclear power-generation sector will be offset by increasing valve sales to coal-fired and combined-cycle natural gas power plants.

According to Freedonia, the global market for automatic valves will outpace that for conventional valves, due to the continuing efforts of process manufacturers to improve operational efficiencies. The strongest gains will be registered in sales of separately sold automatic actuators, which are used together with standard valves to allow for automated valve functions, and are less expensive than automatic control and regulator valves with actuators pre-installed.

The study shows conventional valves will still account for 54 percent of world valve demand in 2015, with suppliers benefiting from the lower cost of these products relative to highly engineered automatic valves.