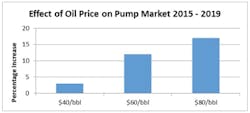

Dominated by oil and gas, the industrial pump market is taking a hit from the plunge in oil prices to $40/barrel and will feel the impact over the next four years, according to the latest forecast by the McIlvaine Company.

At $40/barrel, the pump industry will grow by only 3 percent from 2015 to 2019. However, if prices jump to $80/barrel during the period, the growth increase will be 17 percent, McIlvaine predicts.

Source: McIlvaine Company

In its report, Pumps World Markets, McIlvaine Company says a number of variables will determine the market growth for pumps including, for example, the Iran nuclear agreement and the plunging economy in China, however the drop in oil prices will have the most significant impact.

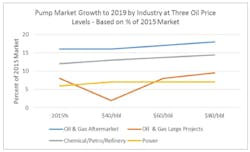

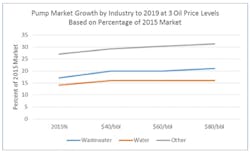

The industrial pump market is dominated by oil and gas, which represents 24 percent of the present market. However, water and wastewater, power, refining, petrochemical and other industries account for 76 percent of the market. The impact of future oil prices on the market can be best predicted by estimating the impact on the individual segments.

Oil and gas can be divided into two segments. The aftermarket and routine purchases for small projects represent two-thirds of the total or 16 percent of the present total pump market. The longer-term large project revenues represent only 8 percent of the current market. If the price of oil were to continue to remain at $40/barrel through 2019, revenues in this segment would shrink over the period.

At $40/barrel oil the long-range pump product revenue from the oil and gas large project segment would shrink by 75 percent from 8 percent of the current market in 2015 to an amount in 2019, which is equivalent to 2 percent of the 2015 market. On the other hand, the oil and gas aftermarket and market for small projects would remain flat during the four-year period. In fact, the market for pumps for pipelines will be positively impacted as low cost oil and gas needs to be moved to more places.

Source: McIlvaine Company

The petrochemical market will grow faster at $40/barrel oil. Municipal water and wastewater will be unaffected by the fluctuation in oil prices. Lower prices will result in more gasoline being consumed and more oil being refined.

The power market will be impacted by greater use of gas turbine combined cycle power plants but total revenues for pumps in the power market will not be impacted greatly by fluctuating oil prices.

Source: McIlvaine Company

McIlvaine Company says it will continue to assess the likely changes in oil prices based on factors such as: the break-even cost for a new well, new technology developments, supply and demand, political developments, regulatory initiatives, and traumatic events.

Some of these developments are more predictable than others. The low oil prices lead to lower extraction activity, which eventually lead to shortages and higher prices. On the other hand, wars, oil spills and earthquakes cannot be easily predicted. As a result there will be the need for continuous changes in the forecasts to take into account the surprises.

For more information about Pumps World Markets, click here.